UK Property Market Update: Gentle Growth as Sellers Adjust to High Competition

The UK property market is experiencing a modest price rise of 0.5% (+£1,805) this month, bringing the average property price to £367,994. While price increases are typically stronger at this time of year, sellers are lowering their expectations in response to a surge in available homes and looming stamp duty changes.

UK Property Market Update: Gentle Growth as Sellers Adjust to High Competition

The UK property market is experiencing a modest price rise of 0.5% (+£1,805) this month, bringing the average property price to £367,994. While price increases are typically stronger at this time of year, sellers are lowering their expectations in response to a surge in available homes and looming stamp duty changes.

🏡 What’s Happening in the Market?

• More Homes for Sale: The number of available homes is at a 10-year high, moderating the usual New Year price surge.

• Stamp Duty Deadline Pressures: With over 550,000 homes sold but awaiting completion, the risk of missing the March 31st deadline is high.

• First-Time Buyers at Risk: Purchases between £500,001 and £625,000 could face an extra £11,250 in stamp duty if transactions don’t complete in time.

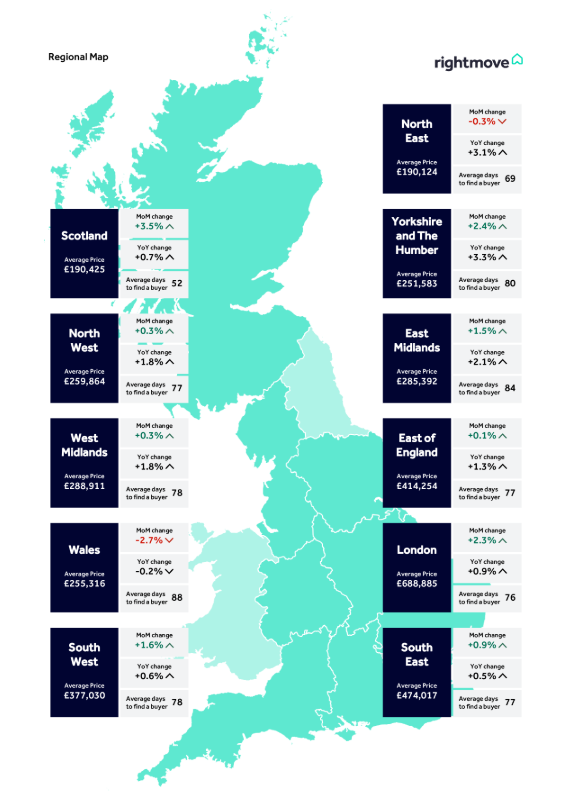

Yorkshire and The Humber: Prices on the Rise

In Yorkshire and The Humber, the market remains sturdy, with property prices seeing significant growth:

• Average Price: £251,583

• Month-on-Month (MoM) Growth: +2.4% 📈

• Year-on-Year (YoY) Growth: +3.3% 📈

• Average Days to Find a Buyer: 80 days

This indicates a stronger market performance in the region compared to the UK average, potentially driven by continued buyer demand and relative affordability.

📊 Buyer Demand & Market Outlook

• Increased Activity: Compared to a year ago, new seller listings are up 13%, buyer demand has grown by 8%, and sales agreed have risen by 15%.

• Mortgage Trends: January saw a record 49% increase in Mortgage in Principle applications on Rightmove.

• Interest Rates: While mortgage rates remain high, they are on a downward trend, offering hope for affordability improvements.

🔮 What’s Next?

Despite economic uncertainty, market momentum remains strong. The slowdown in price increases is helping sustain activity levels, and experts don’t expect a major drop-off after April. However, inflation and earnings reports will be key indicators to watch in the coming months.

🏠 Thinking of buying or selling? Now is a crucial time to act, especially with shifting market conditions. Give us a call on 01748 834373 or fill in the 'Get In Touch' form on our site!

**Information from this article has come from Rightmove's latest house price index**