UK Property Market Update: Savvy Sellers vs. Overpricing

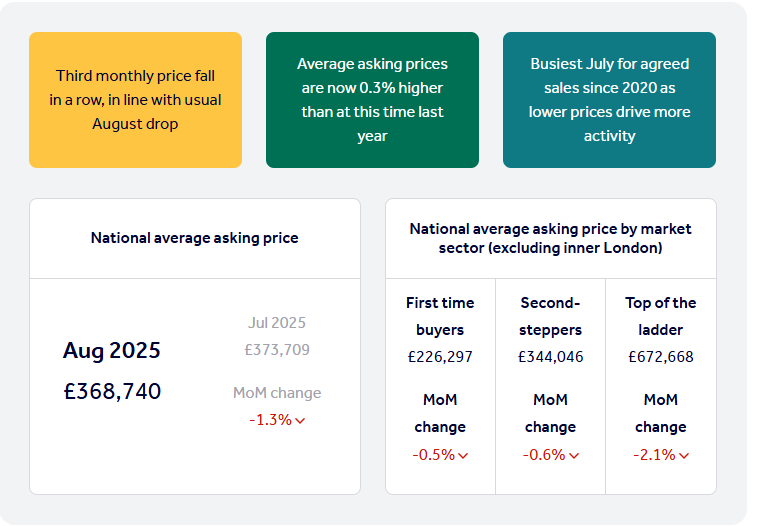

August 2025 brought a notable shift in the UK housing market. Rightmove’s House Price Index recorded a 1.3% drop in asking prices- translating to an average reduction of £4,969 as listings came to market at an average of £368,740.

Rightmove’s latest House Price Index shows that the national average asking price for homes has dipped by a seasonal 1.3% (-£4,969) this August, bringing the typical price of a property coming to market down to £368,740.

While this might sound like a worrying sign, the drop is very much in line with the ten-year August average. After unusually steep falls in June and July, this more typical decline suggests the market is starting to steady itself.

But what does this mean for North Yorkshire’s buyers and sellers?

A Tale of Two Markets

Nationally, the property market is showing a two-speed pattern:

- Some sellers are pricing realistically and securing buyers quickly.

- Others are still overpricing and facing longer waits, often needing to cut asking prices before achieving a sale.

The stats tell the story:

- 34% of homes currently on the market have had a price reduction.

- Properties that are competitively priced find a buyer in 32 days on average, while reduced homes take a far longer 99 days.

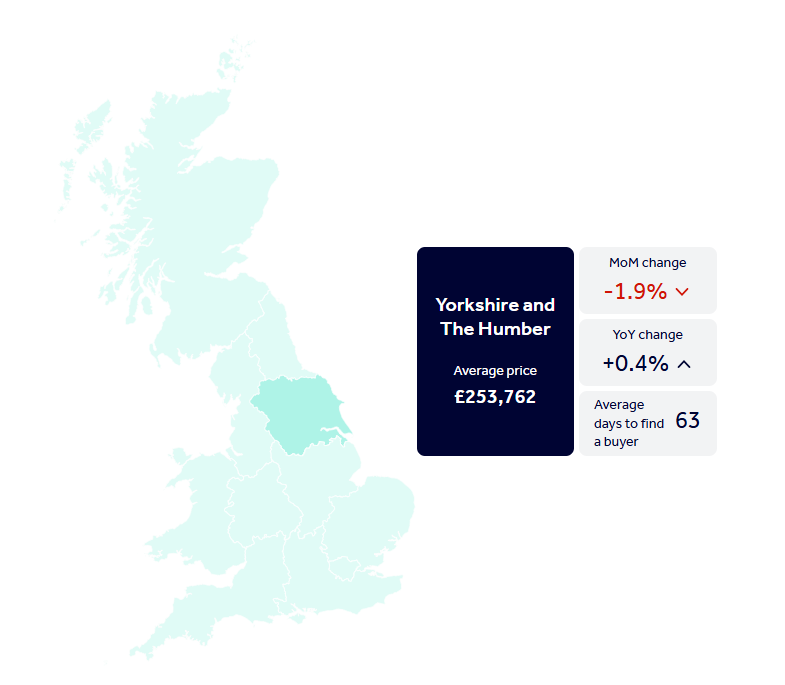

North Yorkshire Outlook

So, what should buyers and sellers in North Yorkshire take away from this?

- For sellers: If you want to move this year, realistic pricing is essential. Overpricing risks long delays and inevitable reductions later.

- For buyers: More homes are available than this time last year, and mortgage deals are improving, so it's a good time to be on the lookout.

- For the market overall: With sales activity rising and affordability gradually improving, North Yorkshire looks set for a steady, competitive autumn housing market- particularly for well-priced family homes and downsizer-friendly properties in sought-after towns.

If you're thinking of a move this year, get in touch with our Sales Team for any advice- 01748 834373