What Is The Current Stamp Duty?

🏡 New Stamp Duty at a Glance

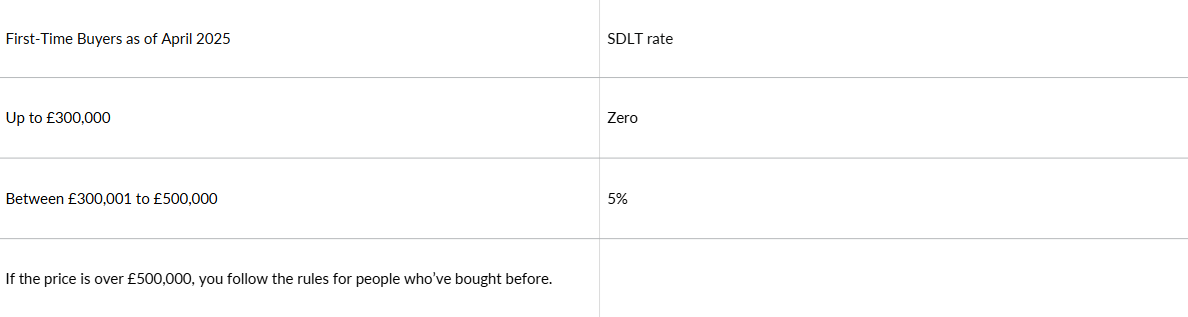

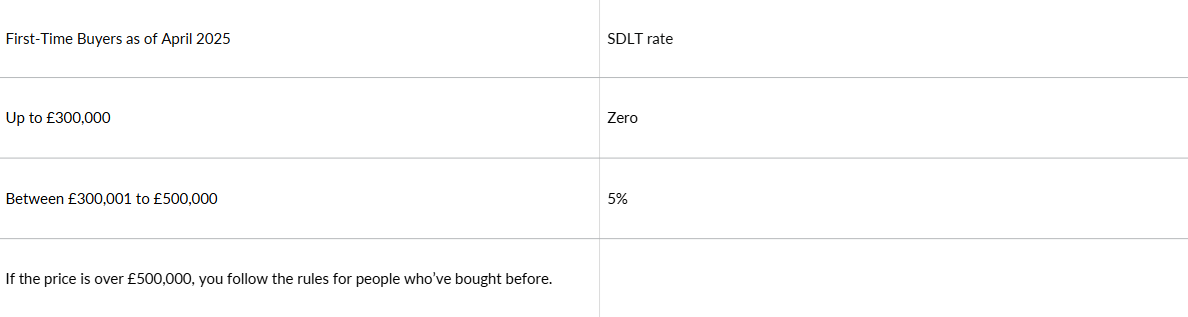

First-Time Buyers

Home Movers

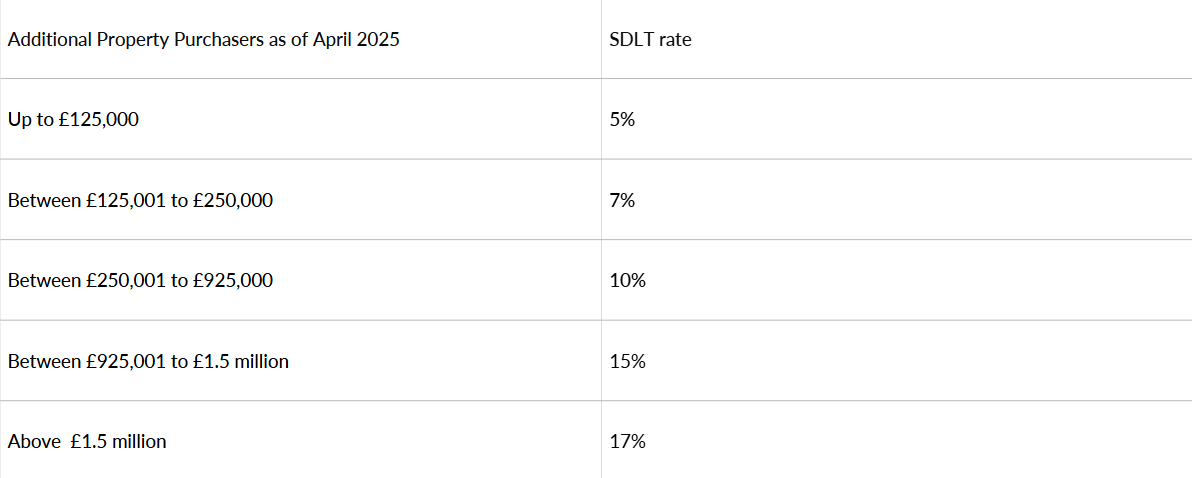

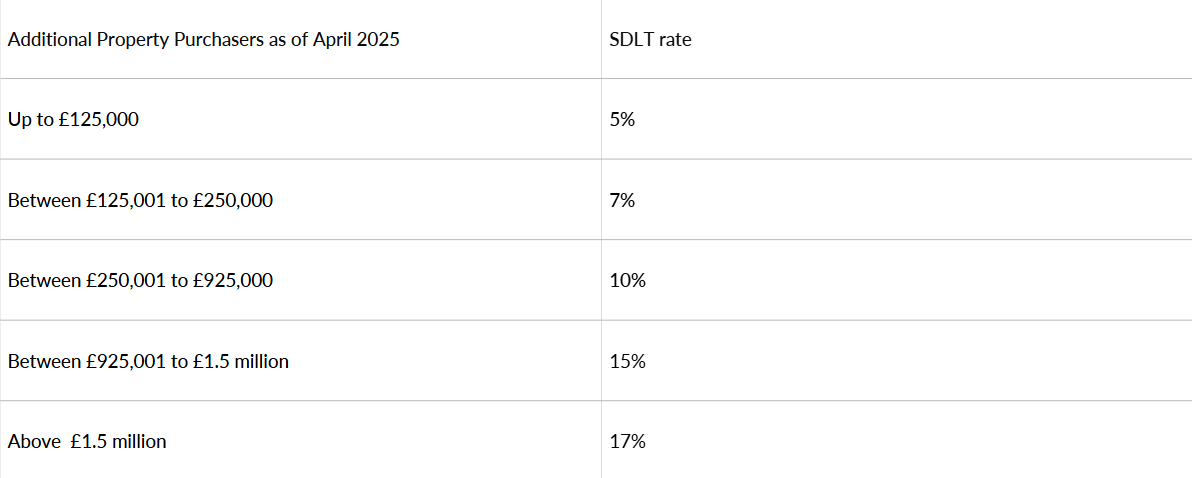

Additional Properties

The latest Rightmove House Price Index shows prices are now 0.5% higher than this time last year, marking a clear shift from the seasonal pause of December to a more confident start to 2026.

The latest Rightmove House Price Index shows the national average asking price at £368,019, effectively unchanged month-on-month (0.0%). Following the strongest start to a year for prices since 2020, February’s pause suggests the market is consolidating rather than accelerating.

From pricing strategy to presentation and timing, selling well is rarely rushed. Early preparation gives you more control, stronger interest, and often a better final price.

Take a look at the most up-to-date figures from Rightmove Plus covering all of February, across our local area- DL11-DL7.