UK Property Market Update: Record Asking Prices vs. Local Reality

The property market in North Yorkshire is feeling the chill this spring. With homes taking an average of 62 days to find a buyer and low offers becoming the norm, we're seeing a clear shift in buyer confidence. Find out what's really happening locally and how sellers can adapt.

UK Property Market Update: Record Asking Prices vs. Local Reality

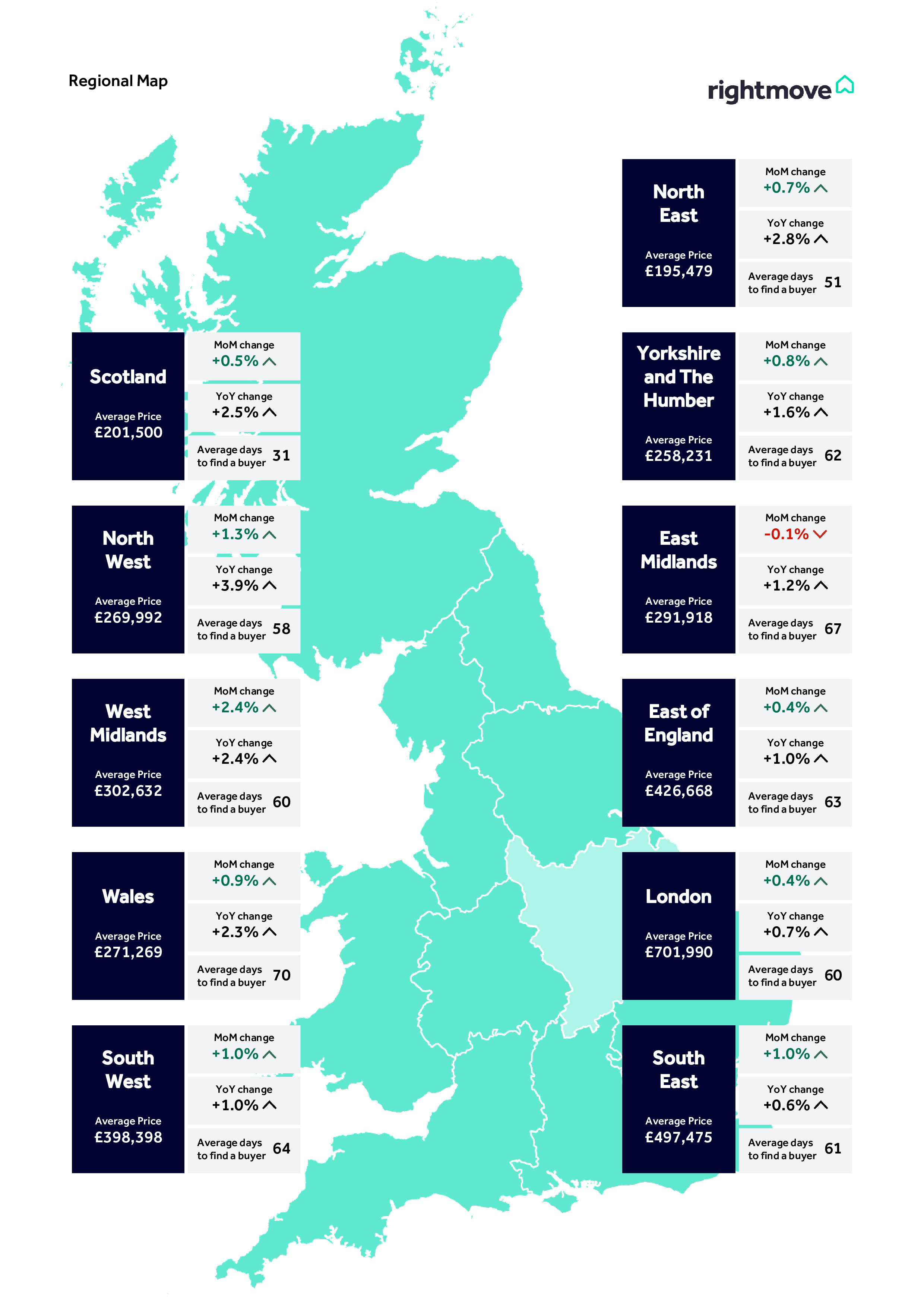

The latest Rightmove House Price Index reveals that the average UK asking price has reached a record £379,517 in May 2025, marking a 0.6% monthly increase. However, this rise is the smallest for May since 2016, indicating a more subdued market compared to previous years.

🏡What’s Happening in the Local Market?

In North Yorkshire, we're observing an average time of 62 days to secure a buyer, which is notably longer than the national average. Buyer activity has been quieter, with many potential purchasers submitting offers below the asking price. This trend suggests that buyers are exercising caution, possibly influenced by the increased number of properties available on the market.

Market Dynamics

The current market conditions favour buyers, given the heightened competition among sellers and the broader selection of properties. Sellers aiming for a successful sale should consider realistic pricing strategies and ensure their homes are well-presented to stand out.

Looking Ahead

With the Bank of England's recent interest rate cut to 4.25%, there's potential for increased buyer affordability, which may stimulate market activity in the coming months. However, sellers should remain adaptable and responsive to market feedback to achieve optimal outcomes.

If you're considering selling your property or seeking advice on navigating the current market, feel free to reach out to our team for personalised guidance.

**Information from this article has come from Rightmove's latest house price index**

If you want to know how the current housing market is affecting your house price, give us a call on 01748 834373 (option2) to book a free valuation, or for some advice from your local property experts!